Shifting Into Neutral and Coasting to the Finish Line

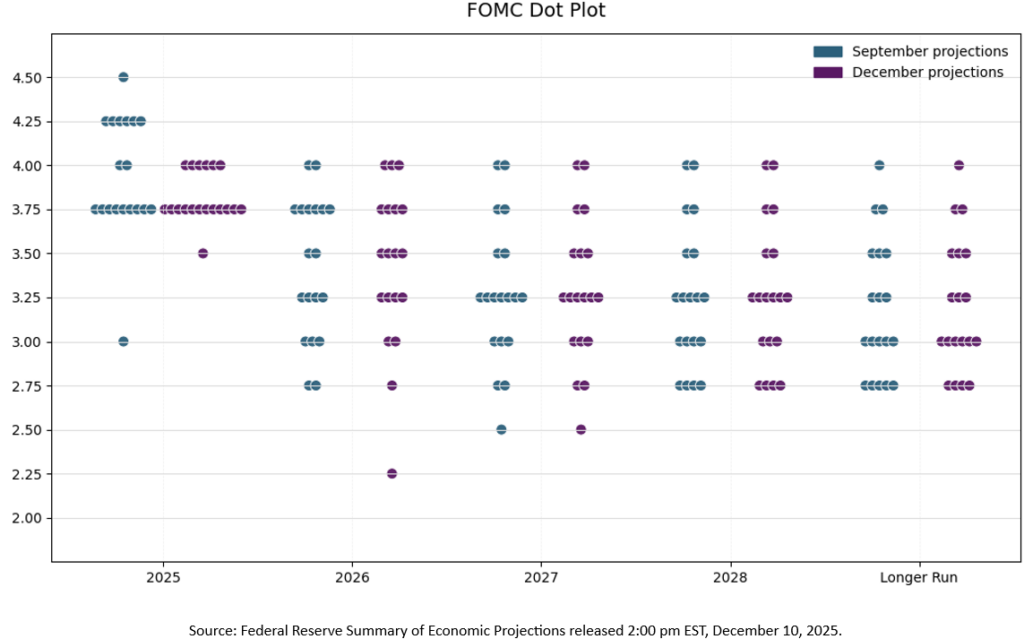

On December 10th the FOMC, or Federal Open Market Committee, cut the Federal funds target rate by 25 basis points to 3.50% – 3.75%. This was the third consecutive cut of the year and likely the last for a while. Given mixed economic signals and a lack of consensus on the FOMC, the bar will be high for additional rate cuts in the near-term.

- The cut was anything but unanimous with 2 members voting not to cut at all, and one member pushing for a larger 50 bps cut. The 3 dissenting votes were the most since 2019.

- Overall economic growth remains steady with the FOMC’s median projection showing 2.3% real growth expected for 2026 and Chair Powell’s comments were mostly upbeat.

- Inflation remains “elevated” relative to the Fed’s 2% target. Economic data is still catching up following the recent government shutdown, but the Fed’s preferred PCE index showed 2.8% annual inflation as of the September report (released in December).

- The Fed did note that downside risks to the labor market have increased. Unemployment ticked up slightly to 4.4% as of the September Bureau of Labor report. The November report is not expected until December 16th.

The conflicting labor and inflation statistics should be enough to give the FOMC pause. As you can see above, the updated Dot Plot also signals little change ahead with the median FOMC projection showing just one cut in 2026. Jerome Powell’s term as Fed Chair is set to end in May meaning he has just three meetings left on his watch. Barring a meaningful uptick in inflation or unemployment in the first quarter of 2026, we expect Mr. Powell to keep it in neutral and coast to the finish line.