2025 Year-End Economic & Market Review with 2026 Outlook

Economic Overview – Slow and Steady

The U.S. economy continued to expand in 2025, though at a slower pace than earlier in the cycle. Real GDP grew at an annualized rate of 2.7% in Q4 2025, while full-year growth came in near 1.9%. Looking ahead, forecasters expect 2026 GDP growth of about 1.8%, signaling modest but sustained expansion. Global growth was more uneven, with Europe experiencing slower recovery and emerging markets showing resilience amid improving trade flows.

Inflation pressures eased but remain stubbornly above the Federal Reserve’s 2% target. Core CPI hovered around 3% at year-end, while the Fed’s preferred measure, core PCE, settled near 2.8%. Projections for 2026 suggest core PCE will decline toward 2.4%, but tariffs and housing costs could keep inflation sticky.

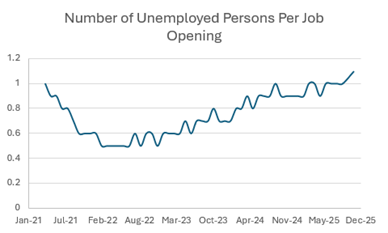

The labor market weakened but remains historically strong. Unemployment ticked down to 4.5% in December after hitting 4.6% in November, while job openings fell to 7.1 million, down nearly 900,000 year-over-year. This cooling trend reflects slower hiring and rising slack, though layoffs remain subdued.

The economy has been described as K-shaped, implying an uneven recovery where different segments of the economy experience vastly different outcomes. Higher-income households and tech-driven sectors continued to thrive, benefiting from strong equity markets, rising asset values, and ongoing innovation in areas such as artificial intelligence and cloud computing.

Conversely, lower-income consumers and traditional industries faced mounting challenges. Persistent inflation in essentials like housing, food, and energy disproportionately impacts households with limited disposable income.

Mixed economic data was sufficient to shift policy to a more neutral position. The Federal Reserve cut rates three times in 2025, reducing the federal funds target range to 3.50%-3.75% from 4.25%-4.50%. For 2026, policymakers project only one additional cut, though market consensus ranges from one to two reductions depending on labor market conditions.

Fixed Income Recap – Clipping Coupons

Anyone else remember the good-old-days when you could collect coupons and earn a return above inflation without any real risk? Bonds staged a strong comeback in 2025. The Bloomberg U.S. Aggregate Bond Index returned 7.6%, its best year since 2020, as falling yields boosted prices.

The 10-year Treasury yield ended 2025 at 4.18%, down from mid-year highs but still elevated relative to pre-pandemic norms. Emerging market debt outperformed dramatically, delivering returns near 20%, supported by a weaker dollar and improving fundamentals. We continue to maintain high-quality exposure and neutral duration in our fixed income portfolios.

Equity Market Recap – Diversification Starting to Work?

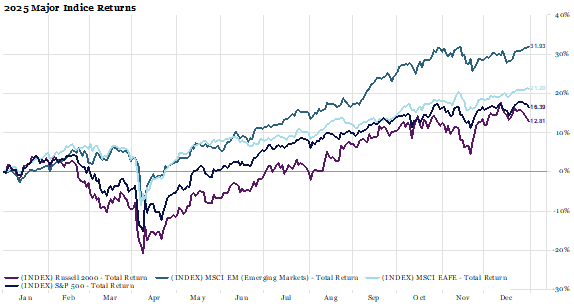

Global equities delivered robust gains in 2025 despite a rough first quarter:

- S&P 500 (Domestic Large-Cap): +16.4%

- MSCI EAFE (International Developed): +32%

- MSCI EM (International Emerging Markets): +21%

- Russell 2000 (Domestic Small-Cap): +12.8%.

For several years, large cap domestic technology stocks appeared to be the only game in town. We urged investors to stay diversified in 2025, and that advice partially paid off. International developed and emerging market stocks both outperformed the domestic large cap index for the first time in many years. Within U.S. stocks, returns continue to be driven by a handful of mega-cap technology stocks.

Valuations remain stretched in U.S. markets, with dividend yields modest compared to EAFE and EM. Concentration risk in the top 10 mega-cap stocks and AI-driven names raises bubble concerns. After years of underperformance, active management may now add value on a risk-adjusted basis given the current concentration risk in equity markets. The top 10 stocks in major indices, particularly the S&P 500, now account for almost 40% of total market capitalization, creating vulnerability if these few names underperform.

An allocation to active management, international, small and mid-cap equities can help reduce the exposure and associated risks of owning a purely passive index fund. Our advice, stay diversified!

Alternative Investments – All that Glitters

Commodities surged in 2025, led by precious metals. Gold soared nearly 65%, silver returned over 140% – both having their best year since 1979. Looking ahead, copper supply constraints are expected in 2026 as demand from electric vehicles and infrastructure accelerates, potentially supporting higher prices.

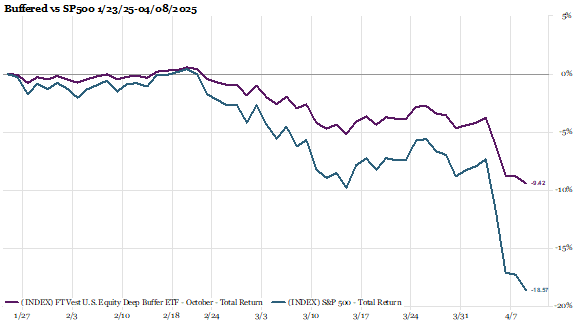

We continue to recommend a position in hedged equity. With U.S. equity valuations near all-time highs, it makes sense to have a little downside protection. As shown below, our buffered ETF positions provided some nice downside protection this past spring when markets sold off sharply. Buffered/hedged equity positions help stabilize a portfolio and enhance risk adjusted returns over time.

Disclaimers:

Past performance is not indicative of future results. Investing involves risk, including possible loss of principal.

This report was prepared with the assistance of AI technology to enhance efficiency and accuracy.

Footnotes/Sources:

1: Atlanta Fed GDPNow, Bureau of Economic Analysis

2: Bureau of Labor Statistics, Federal Reserve

3: U.S. Department of Labor JOLTS Report

4: Federal Reserve FOMC Statements

5: Bloomberg Barclays U.S. Aggregate Bond Index

6: U.S. Treasury Department

7: JPMorgan Emerging Market Debt Index

8: Bloomberg Market Data

9: World Gold Council